Tax Table 2025 Philippines Monthly

Tax Table 2025 Philippines Monthly. It outlines how much tax individuals and. To calculate income tax for ₱150000 salary in the philippines we need to determine the taxable income, check the compensation range, then apply the prescribed withholding tax for that.

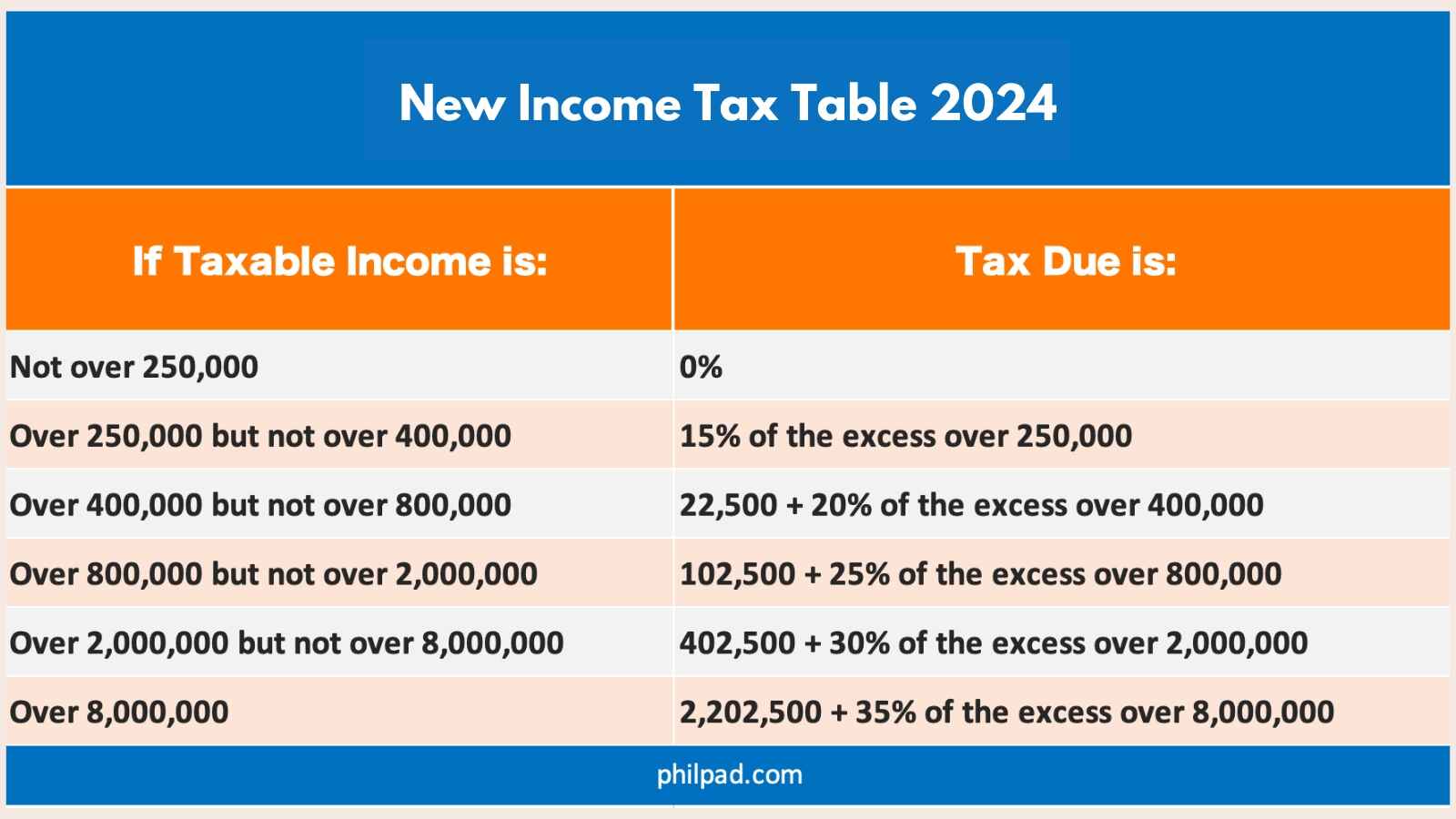

To calculate the income tax due for 2025, follow the updated income tax table in 2025. Use the latest tax calculator to manage your 2025 tax obligations in the philippines.

Tax Table 2025 Philippines Monthly Images References :

Source: charlesmcdonald.pages.dev

Source: charlesmcdonald.pages.dev

Tax Calculator 2025 Philippines Semi Monthly Charles Mcdonald, In the philippines, personal income tax rates vary from 0% to 35%, depending on your earnings bracket.

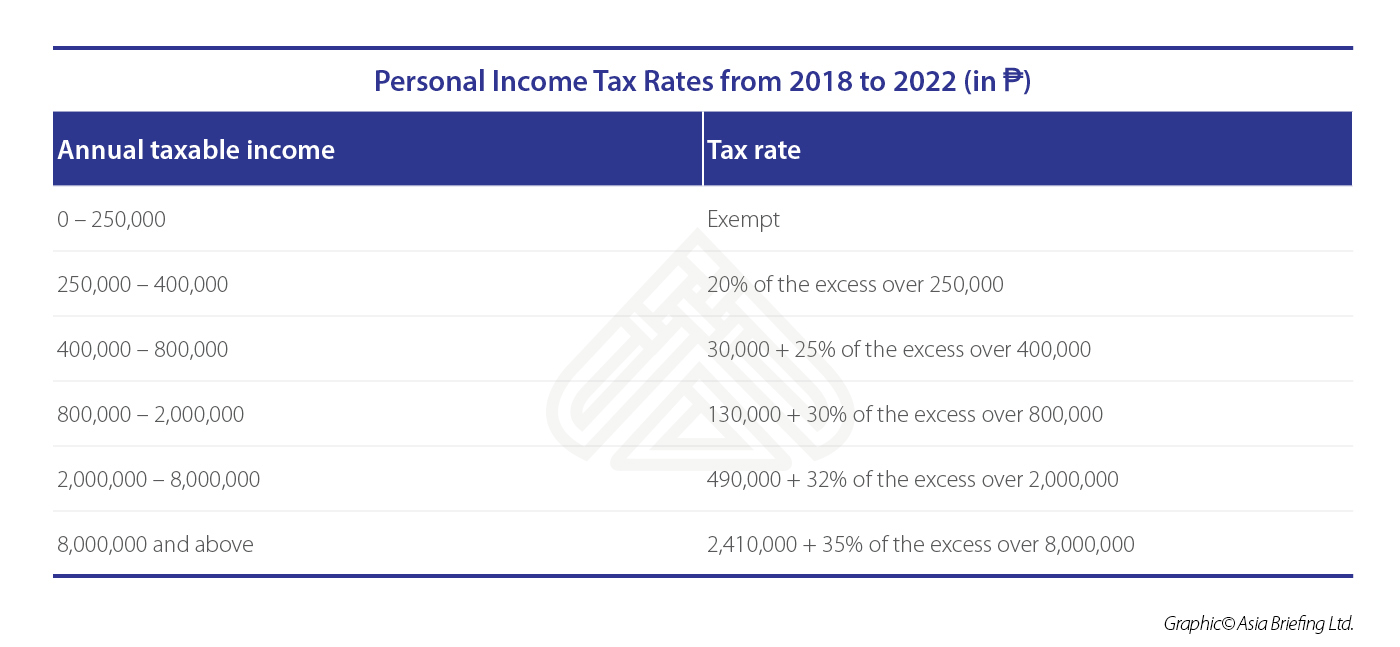

Source: www.aseanbriefing.com

Source: www.aseanbriefing.com

The Philippines’ New Tax Reform Package Approved ASEAN Business News, This guide offers detailed insights into the.

Source: fayebcamilla.pages.dev

Source: fayebcamilla.pages.dev

Irs 2025 Tax Tables Pdf Terry Aeriell, This table serves as a guide for both employees and.

Source: alidiayprissie.pages.dev

Source: alidiayprissie.pages.dev

Tax Table 2024 Monthly Philippines Bryn Marnia, This will show you a detailed breakdown of your monthly contributions based on your.

Source: florriballianora.pages.dev

Source: florriballianora.pages.dev

Monthly Tax Tables 2024/2025 Netti Sarene, Registered business enterprises (rbes) 20%:

Source: www.pelajaran.guru

Source: www.pelajaran.guru

Tax Table 2022 Vs 2023 Philippines Current PELAJARAN, The 2025 national budget signed on dec.

Source: sulahjkdoralyn.pages.dev

Source: sulahjkdoralyn.pages.dev

2025 Tax Brackets Vs 2025 Taxes Emyle Isidora, For a p25,000 salary, for example, the total monthly contribution would amount to p3,780.

Source: www.carfare.me

Source: www.carfare.me

2019 Tax Philippines Table carfare.me 20192020, To calculate income tax for ₱50000 salary in the philippines we need to determine the taxable income, check the compensation range, then apply the prescribed withholding tax for that.

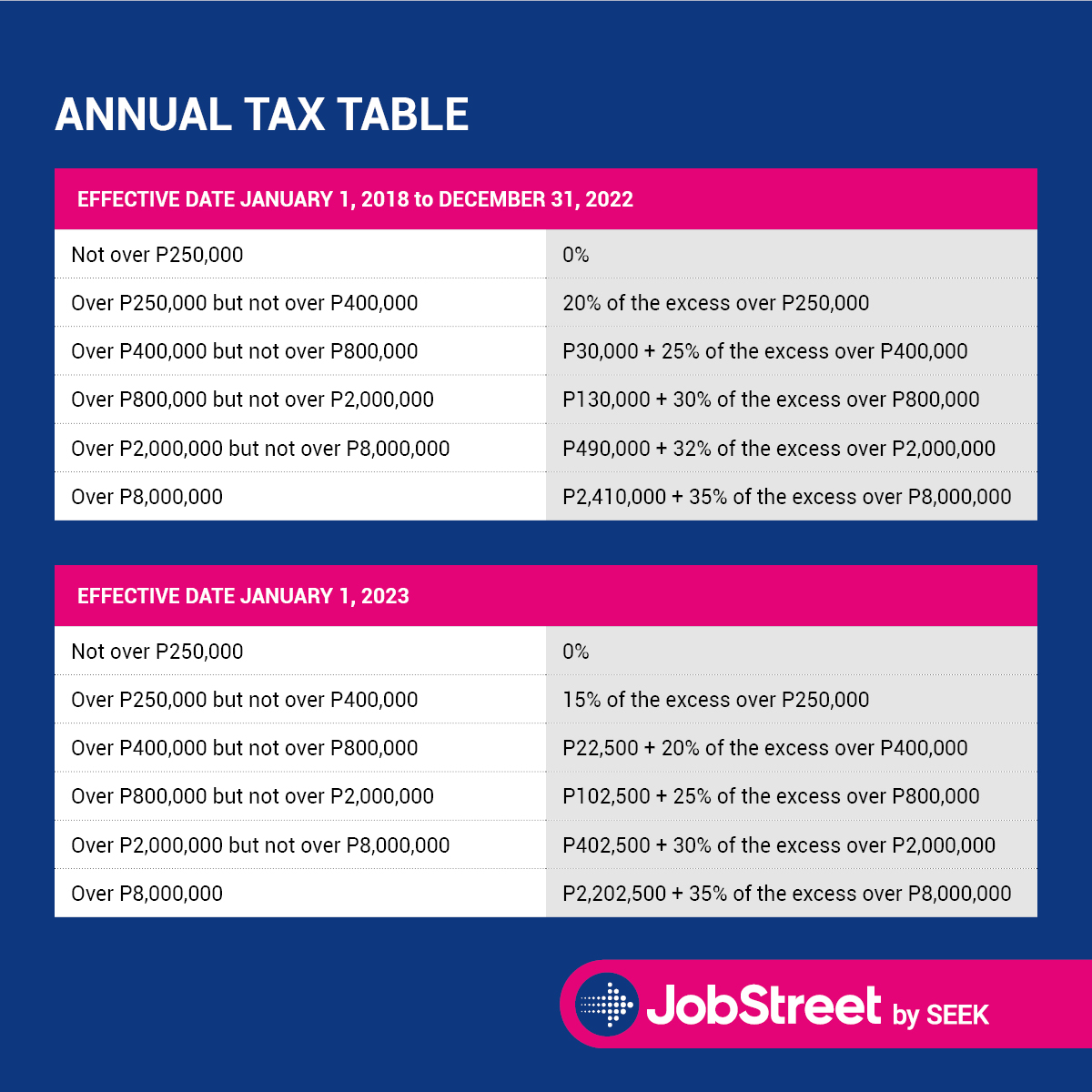

Source: www.jobstreet.com.ph

Source: www.jobstreet.com.ph

The 2022 Bir Tax Table Jobstreet Philippines, To determine your sss contributions, you must check the latest version of the contribution tables below.

Source: 2025weeklymonthlyplanner.pages.dev

Source: 2025weeklymonthlyplanner.pages.dev

IRS 2025 Tax Rates A Comprehensive Guide To Projected Tax Brackets And, Determining monthly income tax deductions effortlessly.

Posted in 2025