2025 Irs 401k Limits Chart

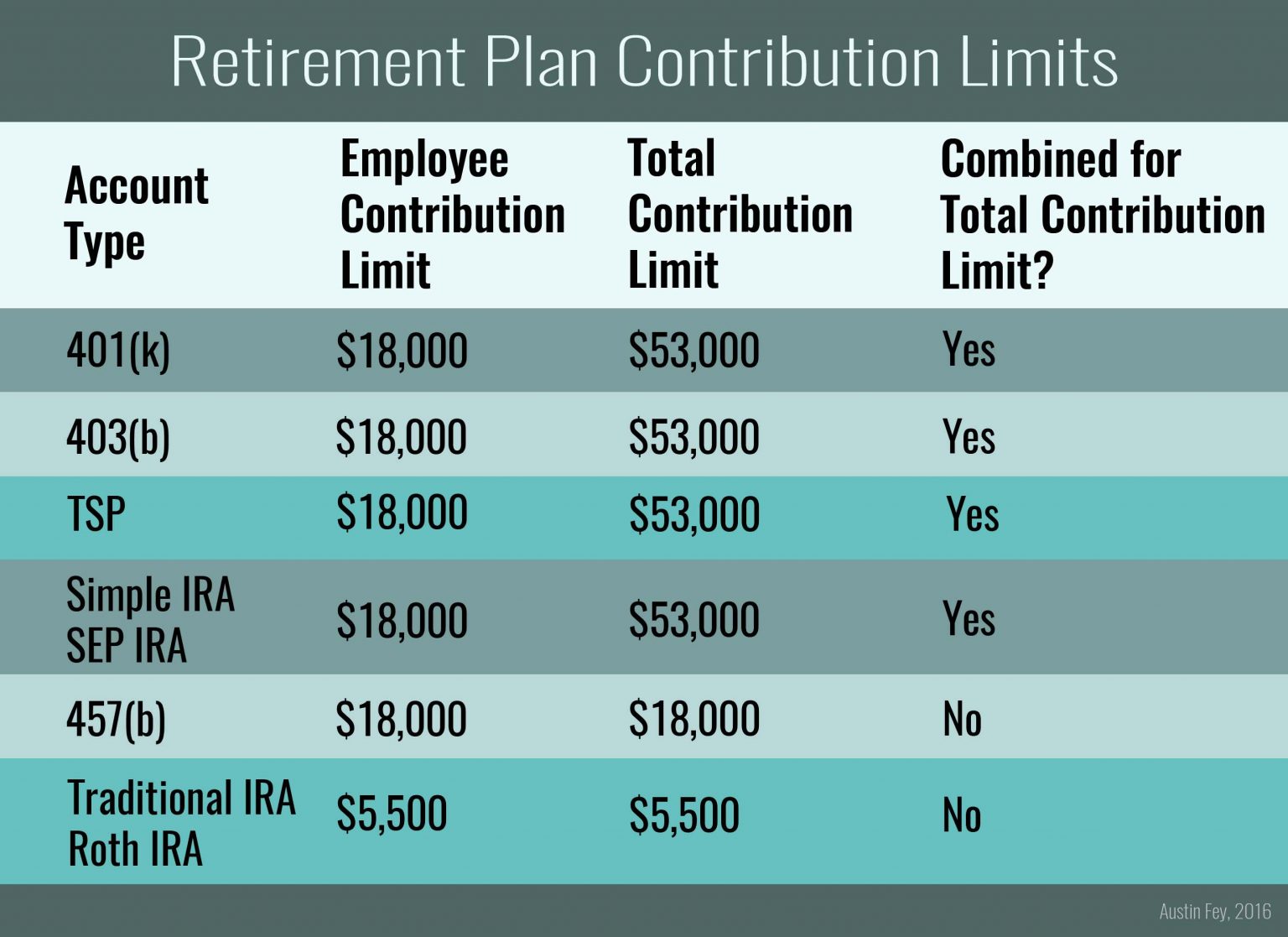

2025 Irs 401k Limits Chart. Additionally, the total contribution limit for defined. 1, 2025, the following limits apply for qualified retirement plans and iras:

Employee contribution limits go up $500 more in 2025, to $23,500 from $23,000. The 2025 401 (k) contribution limit for employees—the same as.

2025 Irs 401k Limits Chart Images References :

Source: douglasmworth.pages.dev

Source: douglasmworth.pages.dev

Irs 401k Limits 2025 And Employer Matching Douglas M Worth, 401(k) and 403(b) plans employee 401(k) contributions:

Source: amirarose.pages.dev

Source: amirarose.pages.dev

2025 401k Contribution Limits Irs Amira Rose, The contribution limit will increase to $23,500, up from $23,000 in 2024.

Source: inesriley.pages.dev

Source: inesriley.pages.dev

2025 Max 401k Contribution Limits Catch Up Ines Riley, The 401k contribution limits are normally released by the irs in fall (october or november) for the next year.

Source: codieasechristan.pages.dev

Source: codieasechristan.pages.dev

401k Contribution Limits 2025 Employer And Employer Giulia Lauree, The irs has also announced the individual retirement account (ira) limits effective january 1, 2025.

Source: jeannehjktamera.pages.dev

Source: jeannehjktamera.pages.dev

401k Contribution Limits 2025 Chart Uta Libbey, When will the irs release 401k contribution limits 2025?

Source: judydingram.pages.dev

Source: judydingram.pages.dev

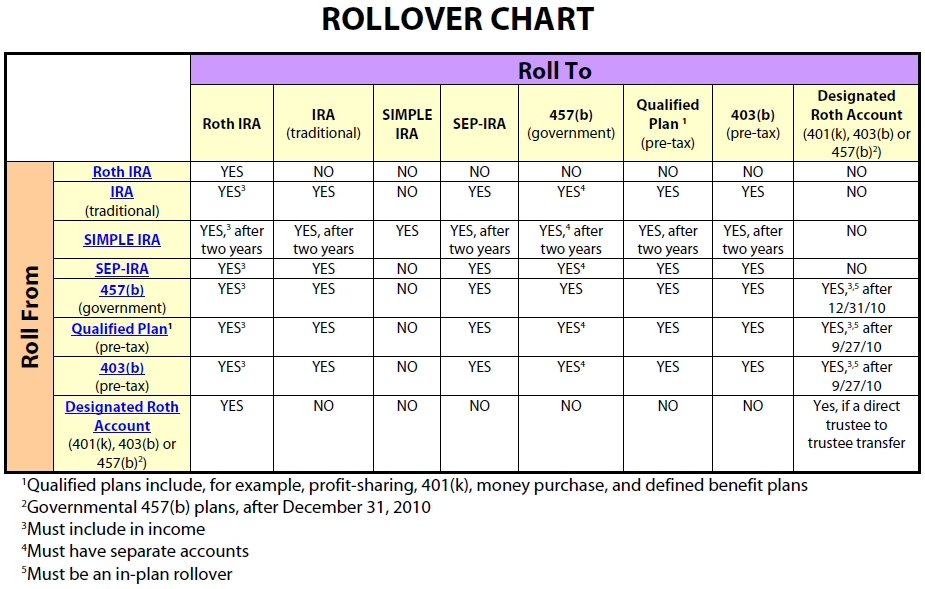

Irs 401k Limits 2025 And Employer Matching Judy D Ingram, 401 (k), 403 (b), 457 plans:

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png) Source: krisaserandie.pages.dev

Source: krisaserandie.pages.dev

401k Contribution Limits 2025 Employer Match Chart Lois Sianna, Annual benefit limit per participant:

Source: samirahope.pages.dev

Source: samirahope.pages.dev

Employee Employer Combined 401k Limits 2025 Samira Hope, Contribution limits are subject to annual adjustments by the irs, requiring individuals to consult the latest guidelines.

Source: josieasetabbie.pages.dev

Source: josieasetabbie.pages.dev

401k Contribution Limits 2025 Chart Betsy Charity, In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Source: lucascarter.pages.dev

Source: lucascarter.pages.dev

401k Contribution Limits 2025 Catch Up Total Cost Lucas Carter, Contribution limits for 401 (k), 403 (b), most 457 plans, and the federal government's thrift savings plan will increase by $500 for 2025.