2024 Ira Contribution Limits Estimated Tax Form

2024 Ira Contribution Limits Estimated Tax Form. What are the ira contribution limits for 2024? Ira contribution limits traditional ira contribution limits.

Modified agi limit for traditional ira contributions increased. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

2024 Ira Contribution Limits Estimated Tax Form Images References :

Source: gabiyellissa.pages.dev

Source: gabiyellissa.pages.dev

2024 Ira Contribution Limits Estimated Tax Form Nelle Yalonda, For 2020 and later, there is no age limit on making regular contributions to traditional or roth iras.

Source: clarieqkarlee.pages.dev

Source: clarieqkarlee.pages.dev

2024 Ira Contribution Limits Estimated Tax Form Ella Nikkie, The irs has increased the contribution limits for the tax year 2024.

Source: patriziawbekki.pages.dev

Source: patriziawbekki.pages.dev

Coverdell Ira Contribution Limits 2024 Inge Regine, 1 this delivers another opportunity for you to boost your retirement savings and reduce your tax burden.

Source: gabiyellissa.pages.dev

Source: gabiyellissa.pages.dev

2024 Ira Contribution Limits Estimated Tax Form Nelle Yalonda, Morgan professional to begin planning your 2024 retirement contributions.

Source: gabiyellissa.pages.dev

Source: gabiyellissa.pages.dev

2024 Ira Contribution Limits Estimated Tax Form Nelle Yalonda, You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Source: reinemorgan.pages.dev

Source: reinemorgan.pages.dev

Roth Ira Contribution Limits 2024 Irs Bibi Victoria, See how much individuals can contribute toward retirement.

Source: sapphirawjohna.pages.dev

Source: sapphirawjohna.pages.dev

2024 Estimated Tax Forms Printable Meggi Winnah, This marks a $500 increase from the 2023 limits, emphasizing the importance of higher contributions for enhanced retirement savings.

Source: aliciabemelina.pages.dev

Source: aliciabemelina.pages.dev

Roth Ira Contribution Limits 2024 Calculator Over 50 Timmi Giovanna, You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Source: kirbeewardys.pages.dev

Source: kirbeewardys.pages.dev

Tax Day 2024 Deadline For Ira Contributions Tamma Fredrika, 2024 ira contribution limits estimated tax form ella nikkie, beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

Source: www.signnow.com

Source: www.signnow.com

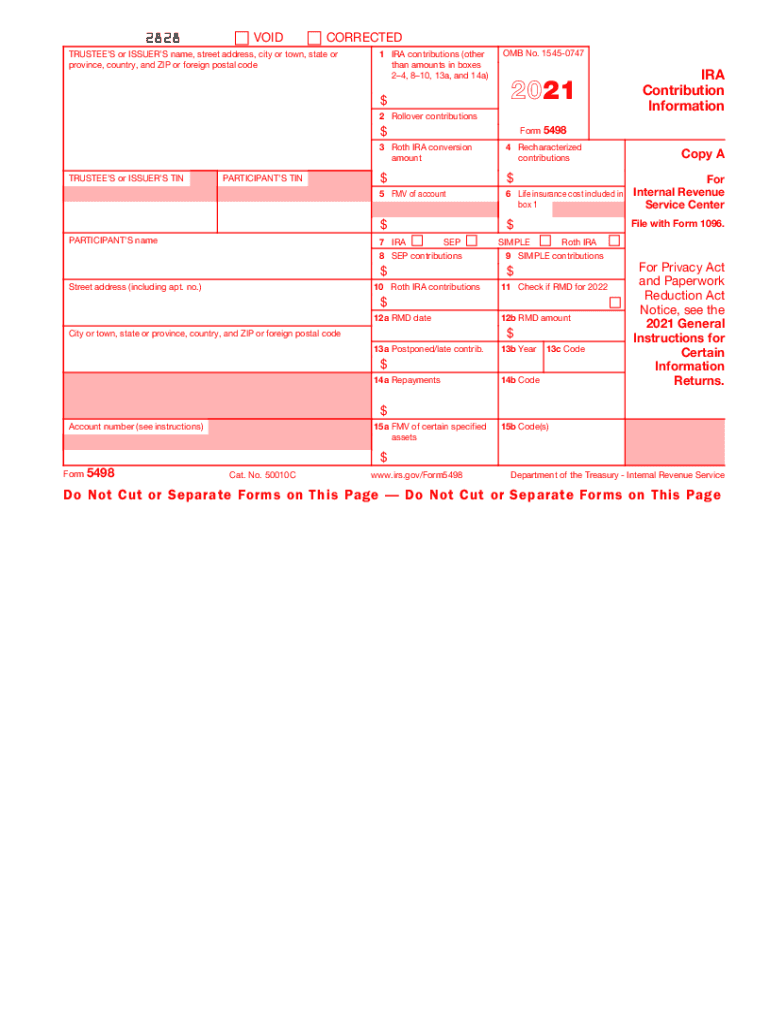

5498 20212024 Form Fill Out and Sign Printable PDF Template, For 2024, the total contributions you can make to all of your traditional iras and roth iras is $7,000 ($8,000 if age 50 or older).

Posted in 2024